28+ How much mortgage will i get

The down payment you make on your home impacts what kind of mortgage you qualify for how much money a lender will give you and the loans terms and conditions. Mon - Fri 800 - 1800.

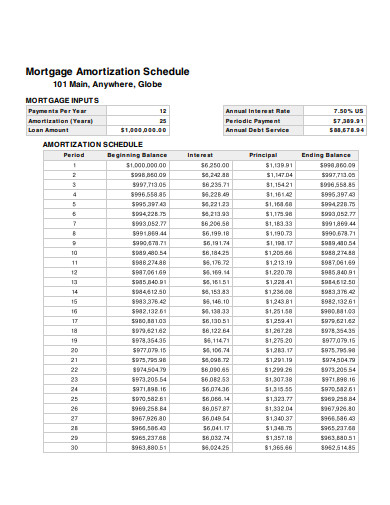

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

The best mortgage lenders for bad credit offer low rates low down payment requirements fast closing and more.

. Interest rates or house prices could fall or you could get a promotion and a pay rise which could vastly increase the amount you are able to borrow. Todays national mortgage rate trends. Once you know the monthly payment you can afford you can use a mortgage calculator to see what mortgage amount and down payment can get you to that monthly payment amount.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. Repayments total interest and amortization to borrow with confidence. We explain the key differences to help you narrow down your choice.

A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes.

Find the right lender for you on our expert-reviewed list. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. This includes the guarantee for the bank on the property and must be notarized.

How much would I pay on a 250000 mortgage. Typically lenders cap the mortgage at 28 percent of your monthly income. However there are guidelines that you can follow in order to figure out how much of a mortgage you can afford and qualify for which is where the Maximum Mortgage Calculator comes in.

Helloyour-german-mortgagede 49 30 28 39 3136. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment. Lenders typically require a down payment of at least 20.

Lets say you earn 6000 a month before taxes or other deductions from your paycheck. Although each situation is different its typically not recommended that you put more than 28 of your income toward your mortgage no matter how stunning the dream home. Potential conflict of interest.

Mortgage rates increased following the news of the bailout plan. Before you apply for a mortgage be sure to get a copy of your credit report. With a 20 down payment you can expect to pay roughly 1200 a month for your mortgage on a home at that price.

For a conforming mortgage the type most people get backed by the government-sponsored enterprises Fannie Mae or Freddie Mac instead of a government agency a 20 down payment allows you to. While 20 percent is thought of as the standard down. Overall pet insurance costs an average of 35 a month for dogs and 28 a month for cats in 2022 for 5000 in coverage for the year.

If you make 70000 a year your monthly take-home pay including tax deductions will be approximately 4530. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. The German way to secure your ownership through an impartial notary.

Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan. You can gauge how much of a mortgage loan you may qualify for based on your income with our Mortgage Required Income Calculator. Dying to get back.

Most lenders prefer 28. Maximum is 50 with compensating factors Most lenders accept 43 Should Ideally be 36. For the week ending September 25 the average rate was 609 still far below the average rate during the early 1990s recession when it topped 90.

Get your mortgage contract. Borrowers may request a free copy every 12 months. Year Beginning balance Monthly payment.

Generally lenders prefer to follow the 2836 Rulethat is a household should spend no more than 28 of monthly income on housing expenses and no more than 36 on debt servicing including. The rule of thumb states that your monthly mortgage payment shouldnt exceed 1680 6000 x 28 and that your total monthly debt payments including. In order to get a better idea of what mortgage you can afford you should first check your rates.

What do you do. The Mortgage Calculator provides an overview of how much you can expect to pay each month including taxes and insurance. Generally speaking no more than 25 to 28 of your monthly income should go toward your.

So ideally if we round that 28-to-36 rule to one-third of your take-home income. Dying to get back S3 Ep20 25m 15s Need To Know Searching for answers. That means your mortgage payment should be a maximum of 1120 28 percent of 4000 and your other debts should add up to no more than 1440 each month 36 percent of 4000.

Notarize the purchase contract. An example would be if you had. House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses.

The median home price in the US. How much should I be spending on a mortgage. For example if youre using the 25 post-tax rule and you bring home 5000 per month that means sticking with a mortgage payment of up to 1250.

Some loan programs place more emphasis on the back-end ratio than the front-end ratio. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. So how do mortgage lenders use the 2836 rule of thumb to determine how much money to lend you.

How much to put down. The 30-year fixed-rate mortgage averaged 578 in the week before the plan was announced. S3 Ep20 25m 15s For those crossing the border illegally it is now more deadly than ever before.

You will need to work backward by altering the mortgage cost. Mortgage Rates. The choice of whether to get cash out when you refinance depends on your needs.

How a LendingTree. Mortgage loan basics Basic concepts and legal regulation. According to Brown you should spend between 28 to 36 of your take-home income on your housing payment.

Barnwood Cottage The Boneyard At Round Top Barnwood Builders Barn Wood Farm Cabin

Sales Forecast Templates 15 Free Ms Docs Xlsx Pdf Templates Excel Templates Forecast

Hardship Letter Template 28 Lettering Letter Templates Reading Lesson Plan Template

Land Lord Rental Property Rental Property Management Free Property Rental Property

28 Ways To Save Money Each Month Hanfincal Com

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast By Sam Kwak David Bruce Paperback Barnes Noble

Sample Letter Of Explanation For Mortgage Refinance Luxury Cash Out Letter Template Konusu Lettering Letter Templates Business Letter Template

Macro Shot Of Increase In Mortgage Rate Concept Free Image By Rawpixel Com

Cost Tracker Templates 15 Free Ms Docs Xlsx Pdf Downloadable Resume Template Templates Excel Spreadsheets Templates

Loan Servicing How Does Loan Servicing Work With Example

Total Debt Service Ratio Explanation And Examples With Excel Template

0 Old Highway 50a Tract 3 Columbia Tn Mls 2429623

Alaska Appraisal Continuing Education License Renewal Mckissock Learning

Home Ml Mortgage Ml Mortgage

Personal Balance Sheet Template Balance Sheet Template Word Template Lottery

Second Story Addition Floor Plans Ranch Home Addition Plans Floor Plans

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast Kwak Sam Bruce David 9781087973623 Amazon Com Books